Affirm is a leading Buy Now, Pay Later (BNPL) company, that offers a flexible solution for consumers to make purchases and pay them off over a period of time. But, the question that lingers in the minds of many is what credit score is needed for Affirm? In this comprehensive guide, we aim to answer that question and provide all the necessary information on Affirm’s services.

What is Affirm?

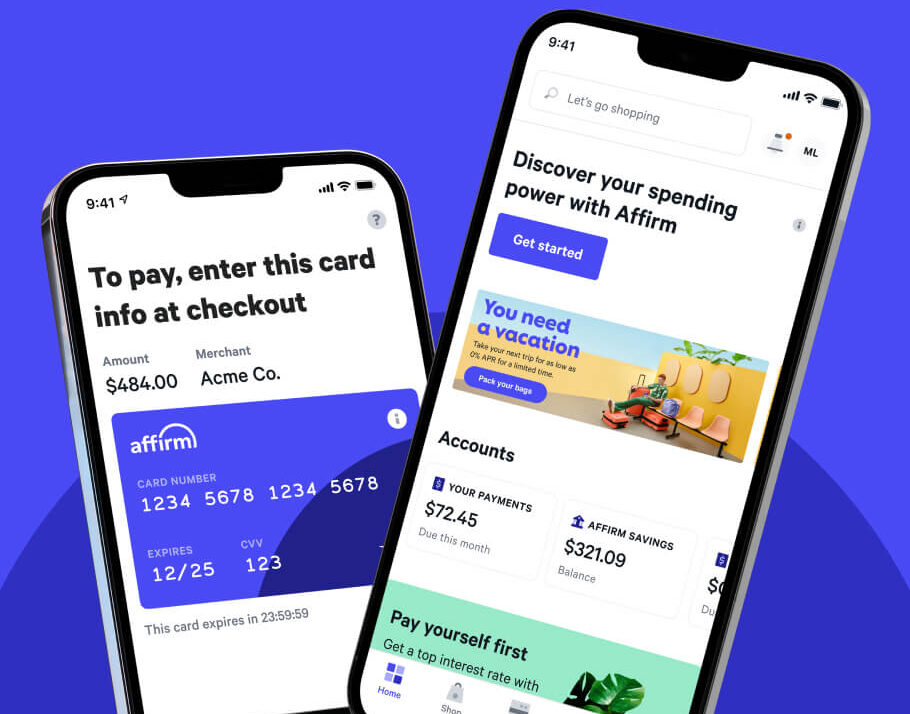

Affirm is a well-known BNPL company that provides customers the option to purchase items and pay for them through installments. It’s a point-of-sale payment plan that allows consumers to take their items home immediately and pay for them over time.

Affirm’s service is available both online and in brick-and-mortar stores, making it a convenient option for a variety of shopping experiences. It offers an alternative to traditional credit cards, aiming to provide a more transparent and consumer-friendly approach to financing.

Understanding Affirm’s Payment Plans

Affirm stands out from the crowd with its flexible payment plans. They offer two primary programs:

- Pay in 4: This is a short-term plan where you can split your purchase into four interest-free payments. These payments are typically made every two weeks.

- Monthly Plan: For larger purchases, Affirm offers a longer-term plan where you can pay off your purchase in monthly installments.

The beauty of Affirm lies in its flexibility, allowing consumers to choose a plan that best suits their financial situation.

The Significance of Your Credit Score

Your credit score plays a pivotal role in your financial journey. It’s a three-digit number that lenders use to assess your creditworthiness. The higher your score, the more likely you are to be approved for loans and receive better interest rates.

When it comes to Affirm, your credit score is also a crucial factor. While they don’t state a strict minimum credit score for approval, having a score of 640 or higher could increase your odds of being approved.

How Does Affirm Evaluate Your Credit Score?

Affirm evaluates your credit score differently from traditional lenders. They conduct a “soft” credit check, which doesn’t impact your credit score.

In addition to your credit score, Affirm also considers various other factors during the loan approval process. These include:

- Your credit utilization ratio

- Your payment history with Affirm

- The length of time you’ve had an Affirm account

- The number of loans you currently have with Affirm

- Verification of your income, debt obligations, and recent bankruptcies

Does Affirm Affect Your Credit Score?

Affirm’s impact on your credit score is quite nuanced. While applying for Affirm’s services results in a soft credit check, which does not affect your credit score, the way you handle your loan with Affirm can impact your credit.

Affirm reports its longer-term loans to the three major credit bureaus. Therefore, if you make on-time payments, it can help boost your credit score. Conversely, missed or late payments can hurt your score.

Pros and Cons of Using Affirm

Just like any financial service, Affirm comes with its own set of pros and cons:

Pros

- No Late Fees: Affirm doesn’t charge any late fees, making it a more forgiving option compared to traditional credit cards.

- Flexible Repayment Options: With Affirm, you can choose a repayment schedule that suits your financial situation.

- Instant Approval: Affirm provides instant approval decisions, allowing you to know immediately if you’re approved for a loan.

Cons

- Potential for High-Interest Rates: Depending on your creditworthiness, the interest rate on Affirm’s monthly payment plan can go up to 30%.

- Risk of Overspending: The convenience and simplicity of BNPL services like Affirm can potentially lead to overspending and accumulating debt.

Applying for Affirm: What You Need to Know

Applying for an Affirm loan is a straightforward process. You can apply at checkout when shopping with one of Affirm’s partnered merchants, both online and in-store.

During the application process, you will need to provide some personal information, including your name, age, valid mailing address, email address, mobile phone number, date of birth, and the last four digits of your social security number.

Affirm vs. Other BNPL Services

Affirm faces stiff competition from other BNPL services like Afterpay and Klarna. While all these services offer the convenience of paying in installments, they vary in their terms and conditions, interest rates, and late fees. Therefore, it’s important to read the fine print and choose the service that best suits your needs.

The Bottom Line: The Credit Score Needed for Affirm

While Affirm doesn’t have a strict credit score requirement, having a score of 640 or above can increase your chances of approval. By understanding how Affirm works and how it impacts your credit score, you can make an informed decision about whether it’s the right option for you.

Remember to use Affirm responsibly, keeping track of your payments and ensuring you don’t overspend. With careful use, Affirm can be a handy tool for managing large purchases.

Now that you’re equipped with all the necessary information, you can apply for Affirm here and start your BNPL journey today!