Navigating the world of finance with bad credit can be a challenge. However, you really don’t have to worry. There are lenders out there who are more than willing to help. And yes, you read that right! Poor credit is not a death sentence in the world of finance. In fact, there are options for bad credit personal loans guaranteed approval $5,000 that are specially designed for people just like you.

In this guide, we’ll jump into the bad credit personal loans, providing tips on how to apply, and direct you to places where you can apply for these loans. The best part? This guide is written in a simple and easy-to-understand!

Decoding Bad Credit Personal Loans

A bad credit personal loan is a financial lifeline designed for those grappling with a less-than-ideal credit history. These loans are a boon for the “I need money now” brigade who are often turned away by traditional lenders due to their credit scores.

What sets these loans apart is that they are typically unsecured. This means borrowers don’t have to pledge any collateral like property or assets to secure the loan. This makes these loans, akin to same-day loans, a desirable option for many.

The Magic Number: $5,000

One might wonder, why $5,000? The answer lies in the balance between risk and reward. A loan of $5,000 is substantial enough to cover significant expenses, yet small enough to be manageable for repayment, even for those with a shaky financial track record.

Getting a Grip on Interest Rates and Terms

While these loans are a helpful resource, borrowers should be aware that the interest rates on bad credit personal loans guaranteed approval $5,000 could be higher than traditional loans. The silver lining here is that some lenders offer competitive rates, making these loans a more affordable option.

The repayment terms are often flexible, catering to the borrower’s financial capacity. This flexibility makes the repayment process less daunting, ensuring that borrowers can manage their loan effectively.

How to Apply for Bad Credit Personal Loans Guaranteed Approval $5,000

Applying for bad credit personal loans guaranteed approval of $5,000 is a walk in the park. Most lenders have an online application process where borrowers need to fill out a form with basic information such as their name, address, and income.

Upon submission, the lender reviews the application and usually gives a decision within a few hours. Once approved, the funds can be in the borrower’s account in as little as one business day. The speed and convenience of this process make these loans an ideal option for those in need of cash quickly.

Top Lender for Bad Credit Personal Loans Guaranteed Approval $5,000

Money Mutual

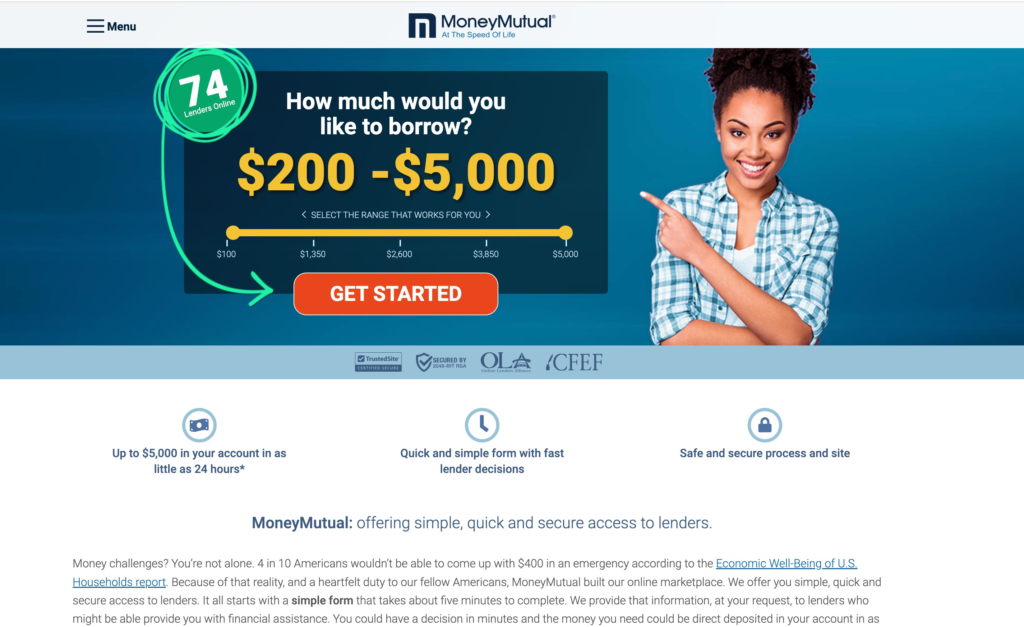

Among lenders offering bad credit personal loans guaranteed approval of $5,000, a standout is – MoneyMutual.

Money Mutual is a financial services company focused on connecting borrowers with a network of short-term lenders. They provide an online platform where people who need loans can submit their information, and Money Mutual matches them with potential lenders who may be willing to offer the requested loan amount.

What is Money Mutual?

It’s important to note that Money Mutual is not a direct lender but acts as a facilitator in the loan-finding process. Borrowers can receive loan offers from multiple lenders, compare terms, and choose the option that best suits their needs.

With a high approval rate, an easy application process and a host of lenders to choose from, MoneyMutual can be a great ally for those with bad credit.

Pros of MoneyMutual

- Swift approval and disbursement of loan

- Streamlined application process

- A wide range of lenders to choose from

- Acceptance of bad credit scores

- Flexibility in the usage of loan funds

Cons of MoneyMutual

- Potentially high interest rates

- Cap on loan amounts

- Not available in all states

FAQs on Bad Credit Personal Loans Guaranteed Approval $5,000

Q: Can I get a personal loan if I have bad credit?

A: Absolutely! Bad credit personal loans are designed specifically for individuals with poor credit scores.

Q: How quickly can I get a bad credit personal loan?

A: Many lenders offer same-day or next-day funding, allowing you to access the funds you need rapidly.

Q: What factors should I consider when choosing a bad credit personal loan?

A: Key considerations should include the lender’s reputation, interest rates, fees, and repayment terms. It’s also wise to read the fine print to understand potential penalties or charges.

In a Nutshell

Having bad credit doesn’t mean you’re out of options when it comes to securing a personal loan. With bad credit personal loans guaranteed approval $5,000, you can get the relief you need without the headache of traditional lenders.

Remember, it’s important to use these loans responsibly. Timely repayments can help improve your credit score and put you on the path to a healthier financial future. So, don’t let bad credit hold you back. Embrace the opportunity that these loans provide and take one step closer to financial freedom.