Small business credit cards are not just a convenient way to pay for services and goods; they are much more than that. They act as powerful financial tools, offering you the ability to manage cash flow, track spending, and even earn rewards. If you’re in the market for the best small business credit cards, you’ve landed on the right page. We’ve done the heavy lifting for you, compiling a list of the best options out there. We’ve considered factors like rewards programs, introductory APR offers, annual fees, and more to bring you this comprehensive guide.

What’s the Big Deal with Small Business Credit Cards?

To understand the appeal of small business credit cards, we need to understand what they offer. Let’s take a look at their unique features:

- High credit limits: These cards often come with higher credit limits, which can be a boon for businesses making large purchases.

- Separation of expenses: They enable business owners to separate personal and business expenses, a crucial aspect during tax season.

- Rewards programs: Many small business credit cards offer lucrative rewards programs, including cash back and travel rewards.

- Building credit: Using a business credit card responsibly can help build your business credit score, which can be beneficial in securing business loans in the future.

Applying for a Business Credit Card: What You Need to Know

Applying for a business credit card isn’t rocket science, but it does require some additional information compared to applying for a personal credit card. You’ll likely need to provide details about your business, including the Employer Identification Number (EIN) and revenue figures. Additionally, most small business credit cards require a personal guarantee. This means you, as the business owner, are personally liable for any debts the business incurs on the card.

Don’t fret if your business is new or if you have no credit or bad credit. You still have options. Secured business cards or business cards designed for those with fair credit might be your ticket. The process might seem daunting initially, but chatting with a bank representative can help clarify your specific issuer’s process and considerations.

Can You Get a Business Credit Card for Personal Use?

While it’s not technically illegal to use a business card for personal use, it’s generally frowned upon. Most business credit cards have terms and conditions discouraging this practice. Furthermore, mixing personal and business expenses can complicate things during tax season. Plus, business credit cards tend to offer fewer protections for cardholders, making them potentially risky for personal use.

Top Picks: The Best Small Business Credit Cards

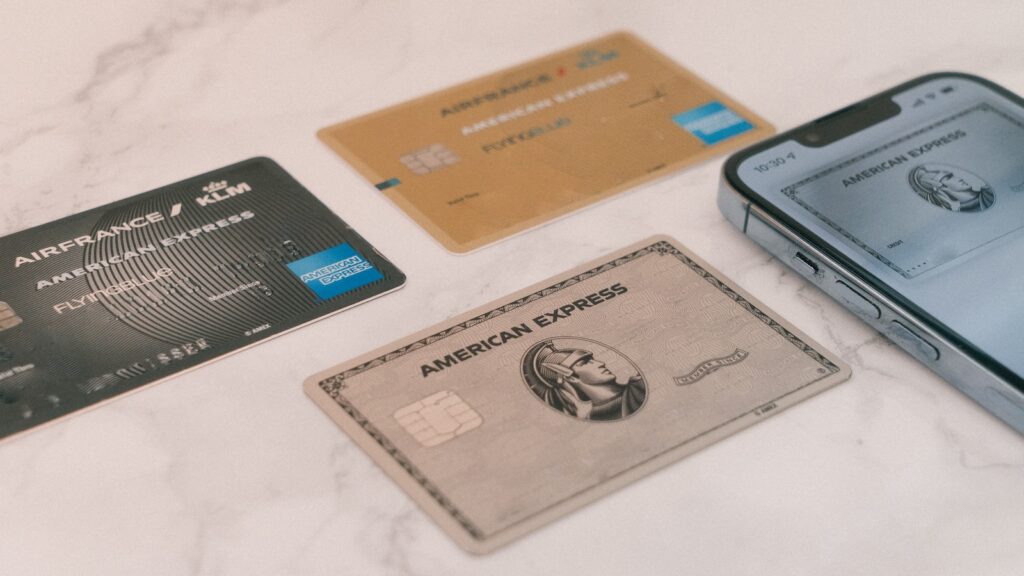

Now that we’ve covered the basics, let’s dive into our top picks for the best small business credit cards. Whether your business spends big on travel, dining, or everyday expenses, there’s a card out there tailored for your needs.

The Business Platinum Card® from American Express: Best for Travel Perks

Why We Love It: Its annual fee might seem steep at first glance, but the Business Platinum Amex comes packed with benefits that can easily offset the card’s annual fee each year. The card offers lounge access, elite status with Marriott and Hilton (enrollment required), and a significant return on spending for travel purchases.

Who Should Use It: This card is an excellent fit for business owners who travel frequently and can maximize the card’s various statement credits.

Ink Business Preferred Credit Card: Best for Bonus Earning

Why We Love It: With a moderate annual fee, the Ink Business Preferred unlocks a range of benefits, including a strong earning structure, valuable insurance benefits, and access to Chase’s full range of airline and hotel transfer partners.

Who Should Use It: Small business owners who spend heavily on travel, shipping, advertising, or internet, cable, and phone services will appreciate this card’s benefits.

Blue Business Plus from American Express: Best Overall Business Credit Card

Why It’s Great: The Blue Business Plus from American Express offers an introductory 0% APR on purchases for the first 12 months after card membership, making it a great choice for businesses looking to pay off large purchases with no interest for an extended period.

Who Should Use It: Small businesses with less than $50,000 in annual expenses want to earn travel rewards for no annual fee and can also utilize an introductory interest rate.

Wrapping It Up

The best small business credit card for your business depends on the specific needs and spending habits of your business. Whether you’re a frequent traveler, dine out often with clients, or make significant business purchases, there’s a card out there for you. Take the time to evaluate your business needs and spending habits before deciding on the perfect card for your business. And remember, no matter which card you choose, use it responsibly to build your business credit and reap the rewards.